FAQ

Here you can find answers to the most common questions about the Fund

Updated 03 September 2021

General information about Atlas Global Macro

The strategy is the same one that Lars Tvede has personally carried out with his own money for the last 30-35 years, which has been very profitable. In other words, a flexible strategy with no geographical restrictions. Allocation to the different asset classes is based on top-down views on e.g. economic and political trends and themes. The primary exercise at any given time is to define which markets and strategies are worth investing in. Often some themes are quite unattractive for many years in a row, while others can be highly profitable. Then it can change - sometimes quickly. The big return difference lies in anticipating this. Secondary is choice of instruments, tactical timing, etc., but even if you are good at it, this becomes difficult if you choose the wrong theme - but easy if you choose the right one.

Lars Tvede, the fund's primary idea-generator and investment decision-maker, has spent an average of three hours a day for many years as an investor reading analyses from a number of the world's leading investment banks as well as private subscription-based research institutions. This approach continues to be used, albeit with the help of a small team who together continuously screen the often voluminous material and group it by relevance, theme, etc. The analysts' information and arguments are taken into consideration, but the conclusions and decisions are ultimately made by Lars Tvede himself.

Yes, the fund can invest in equities, bonds, credit bonds, precious metals, commodities and currencies.

Yes, when deemed appropriate, the fund can leverage capital by (expected) up to 5x (net). However, this flexible framework will not be fully utilised at all times. Conversely, there may also be periods when all of the Fund's money is not invested if good opportunities are not deemed to exist.

Leverage is achieved through derivatives (e.g. futures and options) - not borrowing. This means that any (extreme) loss can never exceed 100%, and of course no one is liable for more than they have deposited. Derivatives are ultra-liquid and help ensure that investors can buy/sell the fund every month.

The Fund invests exclusively in liquid markets and instruments such as currency swaps, futures, options, ETFs, etc. There are therefore no investments that cannot be exited quickly.

The fund is accumulating, but you can choose to reduce or sell your exposure entirely if you want to get some liquidity out of it. For more information, see the section "in and out of the Fund".

No, the Fund is an Alternative Investment Fund (AIF). A UCITS fund would be too restrictive in terms of the Fund's relatively broad and flexible investment strategy.

Experience shows that many private equity and hedge funds offer good returns, but typically they do not provide particularly interesting information. We therefore aim to communicate our views and inputs to our investors in better ways than are usually seen.

Investors are invited to access news, analysis and a monthly report, etc., on our website and a mobile app. See the section "Investor Profile and Mobile App".

As also stated in the Disclaimer, we cannot provide 'individual investment advice' - therefore we are unfortunately not permitted to answer this type of question. Investors should instead seek advice from their own bank/advisor regarding specific trading strategies. Fortunately, the issue resolves itself, as the themes/ideas we mention in the media and online are of course included in the Fund's 'palette' of investment strategies. Thus, as an investor in the Fund, you are automatically invested in these themes.

Lars Tvede has no motive to withdraw his own investment, as the fund has the best possible set-up for investing professionally. Lars Tvede has designed the set-up himself with his team and Atlas Global Macro's prime broker. How much money Lars Tvede has in the fund at any given time will of course fluctuate with his overall liquidity.

How can I participate?

If you are not already registered, you can sign up at www.atlasglobalmacro.ch. After registration you will receive further information about the practical steps, investment etc.

The fund is aimed at professional and semi-professional investors who intend to invest a minimum amount of EUR 125,000 or DKK 750,000, which can be invested in the Luxembourg-domiciled Atlas Global Macro fund or the Danish-domiciled Atlas Global Macro, kl f, fund, respectively. See the section "Where should I invest?" for further details). There is no cap on the number of investors we take into the fund, as long as you meet the requirements.

Hedge funds, like other "alternative funds", are subject to some rules from the financial supervisory authorities in different countries, which say, among other things, that the minimum investment must be so large.

The fund went live on 26 May 2021. To be approved as an investor, you must first pass a KYC check, which ensures that there is no money laundering, etc.

The KYC process is slightly different in Denmark and Luxembourg, but the main thing is that you can demonstrate that you meet the legal requirement to be a semi-professional investor.

For the Danish-domiciled fund, we have allied ourselves with Fundmarket (see this point), which takes care of onboarding for this fund, while onboarding for the Luxembourg-domiciled fund is handled separately.

The issue of new shares in Atlas Global Macro is temporarily closed due to the decision of the administrator to protect existing investors in the wake of the war in Ukraine and the resulting sanctions. Find out more here.

WHERE SHOULD I INVEST?

All investments are managed through the Luxembourg-domiciled Atlas fund. Investments directly into the fund may include transaction costs and possible fees depending on the investor's bank, making this fund typically best suited for larger investors. To make it easier and cheaper for smaller, Danish investors, we have set up a Danish fund. This fund's activity is exclusively to buy investment certificates in the Luxembourg-domiciled Atlas fund. Thus, the investments of the Danish fund are at all times identical to those of the Luxembourg fund, but the process and costs are different.

The Luxembourg fund is set up in cooperation with Credit Suisse. Larger amounts, typically over EUR 1 million, can be invested directly in this fund (minimum requirement is EUR 125,000).

However, for most investors living in Denmark, it will be simpler (and cheaper) to invest in the Danish fund, which is managed by our partner Fundmarket.

For investors residing in countries other than Denmark, the most obvious choice is to invest in the Luxembourg-domiciled fund, which is also denominated in EUR. However, as a resident abroad, you can invest in the Danish-domiciled fund provided that you have a valid NemID, Danish passport and can transfer in DKK.

However, it is not possible for so-called "US Persons" to invest directly in the fund due to FATCA rules.

In Denmark through Danske Bank, and in Switzerland you can invest through your local bank.

For larger investments, it is also possible to invest directly through Credit Suisse.

The practical process of participating will be sent to you upon registration.

Please note that the funds must be transferred at least 3 banking days before the subscription date (see cut-off times here).

The fund in Luxembourg is denominated in EUR and the fund in Denmark is denominated in DKK. These are the only currencies we can accept.

Yes, you can invest in the Danish fund via Danish holding companies or via private free funds. See the section "Fundmarket" under the point "Private or corporate investment".

Yes, as the fund is accumulative, VSO funds can be used to invest. As mentioned, the Danish fund is an obvious choice. If you invest with VSO funds via Fundmarket, please check that you have a NemKonto linked to your CVR number.

Fundmarket

Fundmarket is our partner who offers the Danish fund, Atlas Global Macro, kl f, in a simple and cost-effective way, handling onboarding, KYC, etc.

The account opening is a simple procedure that takes 10-15 minutes and requires that you have a Danish passport and NemID. The opening involves the establishment of a free investment account on the platform. As part of the process, you will be asked to select investment certificates. Here you only need to click on the "DECLARATION" button, next to the item "Atlas Global Macro, kl f.". The other investment certificates on the list have nothing to do with Atlas Global Macro.

No, Fundmarket is not used as custodian, but is merely a cost-effective offer as an alternative investment process instead of going through your own bank.

Deposits via Fundmarket are transferred to an account at Danske Bank, after which they are invested directly in the fund. Therefore, the money is never held by Fundmarket and investors in Atlas have no bankruptcy risk in relation to Fundmarket. Fundmarket simply makes it easier and cheaper to invest.

Alternatively, you can invest via your own bank by asking it to purchase the relevant ISIN code of the Luxembourg-domiciled fund, but this typically has higher costs than investing via Fundmarket.

You can sign up with both a personal NemID or an employee signature (company NemID). If you invest both privately and via a company, you must register with your personal NemID. During the account opening process, you will be asked whether you also want to create an account for VSO or company. Here you can link the company account to your profile.

You can register with Fundmarket as a foreigner, as long as you have a Danish NemID and account details. However, investors from the USA cannot be handled due to the special FATCA rules applicable to them. Foreign registered companies cannot be handled via Fundmarket, but are instead referred to the fund in Luxembourg.

It is possible to invest certain pension savings via financial institutions in Atlas Global Macro. As some types of pension plans are subject to restrictions, it is only possible to invest installment pensions and possibly capital pensions in the fund.

Not all financial institutions allow investment of pension funds in Atlas Global Macro, but financial institutions should be able to handle it. Currently, Danske Bank and Nordea have confirmed that they support this solution via Fundmarket. Fundmarket has requested this solution from several financial institutions, but is awaiting their response. If you have pension funds in another financial institution than the two mentioned, we therefore encourage you to contact the financial institution and explain that you wish to invest in Atlas Global Macro.

You can also ask your bank to buy the fund into your pension custody account. In other words, you have to actively approach your bank to inquire about the specific possibilities of investing in the fund via pension funds.

Alternatively, in some cases, pension funds can be invested through a company (see section Pension savings).

Nordnet

Nordnet is our partner where you can buy the Luxembourg-domiciled fund directly to your Nordnet account. The advantage is that you have all your securities in one place.

To invest in the fund via Nordnet, you must be registered as a Nordnet customer, which you can do here.

The minimum investment via Nordnet is DKK 950,000 because the investment is made directly in the Luxembourg-domiciled fund.

All relevant documents for the investment via Nordnet can be found on the order forms, where digital signatures can also be made.

Pension savings

Pension savings can typically only be invested in the products that the pension company offers on its unit link platform. Over time, we will try to enter these platforms, but often pension companies prioritise offering their own products.

However, you should be able to instruct any bank in Denmark to purchase the fund via ISIN code.

It is also possible to invest certain types of pension plans via Fundmarket. See "Fundmarket and pension plans" for more details.

We have learned that in Denmark it may be possible to invest in unlisted shares or units through pension plans. There are a number of requirements that must be met (e.g. each person must not own 25% or more of the company). This could be an ApS whose purpose is to invest in Atlas Global Macro. As is the case with tax issues, we recommend seeking local legal advice regarding the possibility of investing via pension plans.

Taxation and Reporting

We cannot and must not advise on the taxation of money invested in the Fund. Investors are advised to seek local tax advice if there are any unresolved issues. Our tax attorney has prepared some documents (see following links) that provide a general description of the tax effects of investing, respectively, in Luxembourg or in Denmark.

If you invest via the Fund in Denmark, Fundmarket reports to SKAT. If you invest via the Fund in Luxembourg, you or the bank you use as custodian bank must report to SKAT. We also refer to the aforementioned document from our tax lawyer for further information.

PWC is the auditor of both the Luxembourg-domiciled fund and the Danish-domiciled fund. Investors receive a monthly report from Atlas Global Macro (via our Investor Area - see below).

As an investor, you can follow your investment via Fundmarket, Nordnet or your bank, depending on how you have invested. In addition, the fund's NAV is published on Bloomberg, Morningstar, Reuters and Telekurs every Thursday afternoon. Other media also provide information on the Fund's NAV, e.g. FundSquare.

We publish our investment report quarterly, and investors can also access news, analyses and a monthly webinar which is posted in our Investor Area on the website and on our mobile app. Find out more in the section "INVESTOR AREA AND MOBILE APP"

Returns and Costs

The fund takes 1% in management fee and 10% of the profit in performance fee (i.e. no profit means no performance fee). In addition, a small fee is paid to the administrator of the fund (see other fees). By comparison, the normal range for hedge funds is 1-2% management fee and 10-20% performance fee.

We take the same performance fee from all returns - calculated from a quarterly high watermark model. Management fees are taken out of NAV on a weekly basis and the management fee is paid on the entire amount the fund manages - including what is run up due to profit.

For investments in the Danish-domiciled fund through Fundmarket, a small administration fee of around 0.1% will be charged. This is automatically and continuously deducted from the Net Asset Value (NAV) of the fund. This small fee also covers custody costs, which at many banks easily exceed 0.1%.

As the costs are always percentages of the different variables such as amount, performance level and timing, i.e. when in the year the different costs are calculated, they will always represent an estimate. A more precise calculation would have to take into account the weekly management fee settlement, and performance fees would have to be calculated quarterly.

Investor Area and Mobile App

Our Investor Area and iOS mobile app are reserved for investors who need to go through a specific process to create an investor profile. Only with an investor profile can you gain access.

See how to gain access in the sections "Investor profile for Fundmarket/own bank/Nordic investors" below.

After creating your investor profile, you will receive an email with further instructions on how to create a separate App access as well.

Eventually, we will synchronise accounts and login information. Until then, we thank you for your understanding and patience with this.

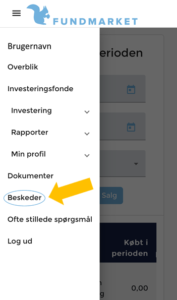

If you have invested via Fundmarket, you can log in to your Fundmarket account and find the instructions for creating an Atlas investor profile under "Messages".

In the instructions, a link as well as a codeare listed, which you will need when creating your investor profile.

Remember, you can't log in to the Atlas Investor Area or the iOS mobile app without going through this process.

For those who have invested directly in the Luxembourg-domiciled fund, Credit Suisse posts the instructions for setting up an investor profile as a so-called "Corporate Action".

However, experience shows that such messages are often not passed on to the customer by the bank, so we typically ask for some form of proof that you are an Atlas investor and have invested in the fund.

This documentation can be a "Subscription Confirmation" or a screenshot of other relevant information, and can be sent to info@atlasglobalmacro.ch for validation, after which you will receive further instructions on the creation of an investor profile.

Nordnet investors receive, after the official subscription date, an invitation via email directly from Nordnet to create an investor profile.

If you have not received an invitation, the easiest way is to contact Nordnet directly.